Not known Details About Top 30 Forex Brokers

Table of ContentsHow Top 30 Forex Brokers can Save You Time, Stress, and Money.About Top 30 Forex BrokersThe Only Guide for Top 30 Forex BrokersTop 30 Forex Brokers Can Be Fun For AnyoneNot known Details About Top 30 Forex Brokers The Best Strategy To Use For Top 30 Forex BrokersAbout Top 30 Forex BrokersExamine This Report on Top 30 Forex Brokers

Like other instances in which they are used, bar charts provide more cost information than line graphes. Each bar graph represents one day of trading and contains the opening cost, highest possible cost, most affordable cost, and shutting rate (OHLC) for a profession. A dashboard on the left stands for the day's opening cost, and a comparable one on the right represents the closing rate.Bar charts for currency trading aid investors identify whether it is a customer's or vendor's market. Japanese rice investors initially utilized candlestick charts in the 18th century. They are visually extra enticing and easier to review than the graph types defined over. The top portion of a candle light is made use of for the opening rate and highest possible cost point of a money, while the reduced portion shows the closing cost and cheapest cost point.

The Best Strategy To Use For Top 30 Forex Brokers

The formations and forms in candle holder charts are used to recognize market direction and movement.

Financial institutions, brokers, and suppliers in the forex markets allow a high amount of utilize, indicating traders can manage big placements with fairly little money. Utilize in the variety of 50:1 prevails in foreign exchange, though also greater quantities of leverage are available from particular brokers. Nonetheless, leverage has to be used very carefully because several unskilled investors have actually endured substantial losses using even more take advantage of than was required or prudent.

The Facts About Top 30 Forex Brokers Revealed

A money trader requires to have a big-picture understanding of the economic situations of the numerous countries and their interconnectedness to realize the basics that drive money values. The decentralized nature of forex markets suggests it is less controlled than other monetary markets. The level and nature of regulation in foreign exchange markets rely on the trading jurisdiction.

Foreign exchange markets are among the most liquid markets worldwide. So, they can be much less unstable than other markets, such as property. The volatility of a specific currency is a feature of several aspects, such as the national politics and business economics of its nation. Events like economic instability in the form of a payment default or discrepancy in trading connections with an additional currency can result in significant volatility.

Our Top 30 Forex Brokers PDFs

Money with high liquidity have a ready market and exhibit smooth and foreseeable price action in action to exterior events. The United state buck is the most traded currency in the world.

Not known Incorrect Statements About Top 30 Forex Brokers

In today's details superhighway the Foreign exchange market is no much longer only for the institutional investor. The last 10 years have actually seen an increase in non-institutional investors accessing the Foreign exchange market and the advantages it supplies.

The 30-Second Trick For Top 30 Forex Brokers

Fx trading (foreign exchange trading) is a internet global market for dealing currencies. At $6. 6 trillion, it is 25 times bigger than all the world's stock markets. Forex trading dictates the exchange prices for all flexible-rate currencies. Consequently, rates change regularly for the currencies that Americans are more than likely to utilize.

All currency professions are done in sets. When you market your money, you receive the repayment in a different currency. Every vacationer that has actually obtained foreign money has actually done foreign exchange trading. When you go on trip to Europe, you exchange bucks for euros at the going price. You market united state

The 10-Minute Rule for Top 30 Forex Brokers

Spot purchases are similar to trading currency for a journey abroad. Places are contracts between the trader and the market maker, or supplier. The investor purchases a specific currency at the buy price from the marketplace maker and sells a various currency at the asking price. The buy price is somewhat more than the selling cost.

This is the deal expense to the trader, which consequently is the profit earned by the market manufacturer. You paid this spread without recognizing it when you traded your dollars for international money. You would observe it if you made the purchase, canceled your journey, and afterwards attempted to trade the currency back to bucks today.

The Best Guide To Top 30 Forex Brokers

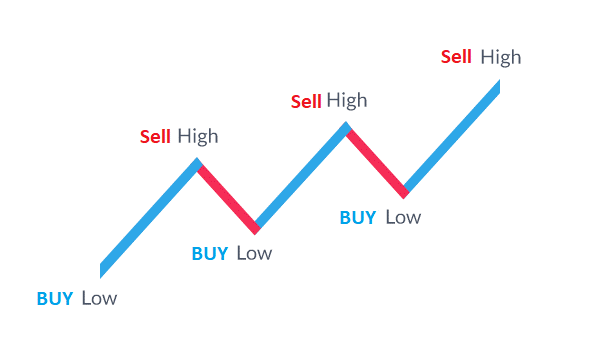

You do this when you think the currency's worth will fall in the future. Organizations short a money to safeguard themselves from threat. Shorting is very dangerous. If the money rises in worth, you have to get it from the dealer at that rate. It has the very same advantages and disadvantages as short-selling stocks.